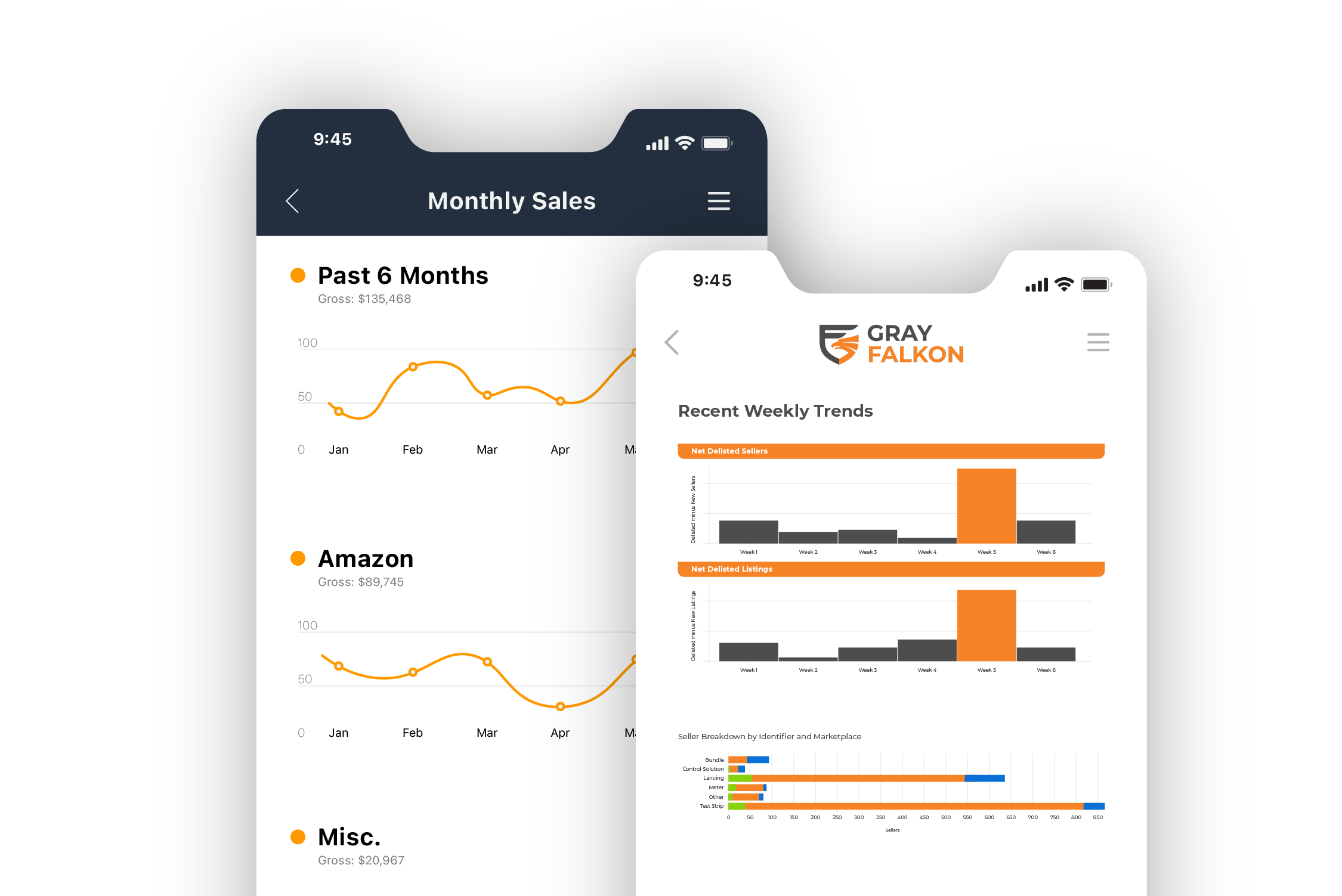

featured blog

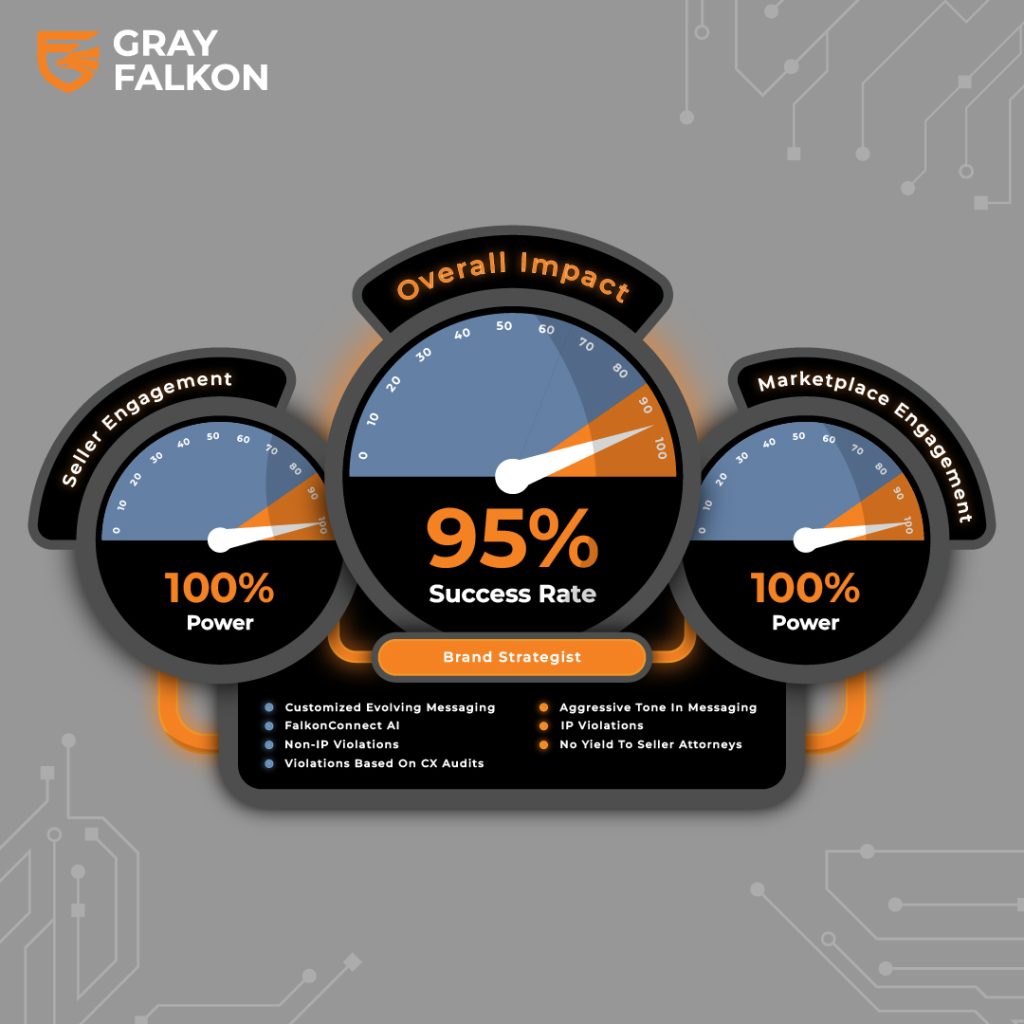

Navigating the Complexities of Brand Protection on Amazon: Why Proactive Strategies Matter

In the ever-evolving landscape of eCommerce, brand protection has become a critical concern for businesses selling on Amazon. Recent research reveals startling insights into the challenges brands face and the strategies they employ to safeguard their reputation and market position.