featured blog

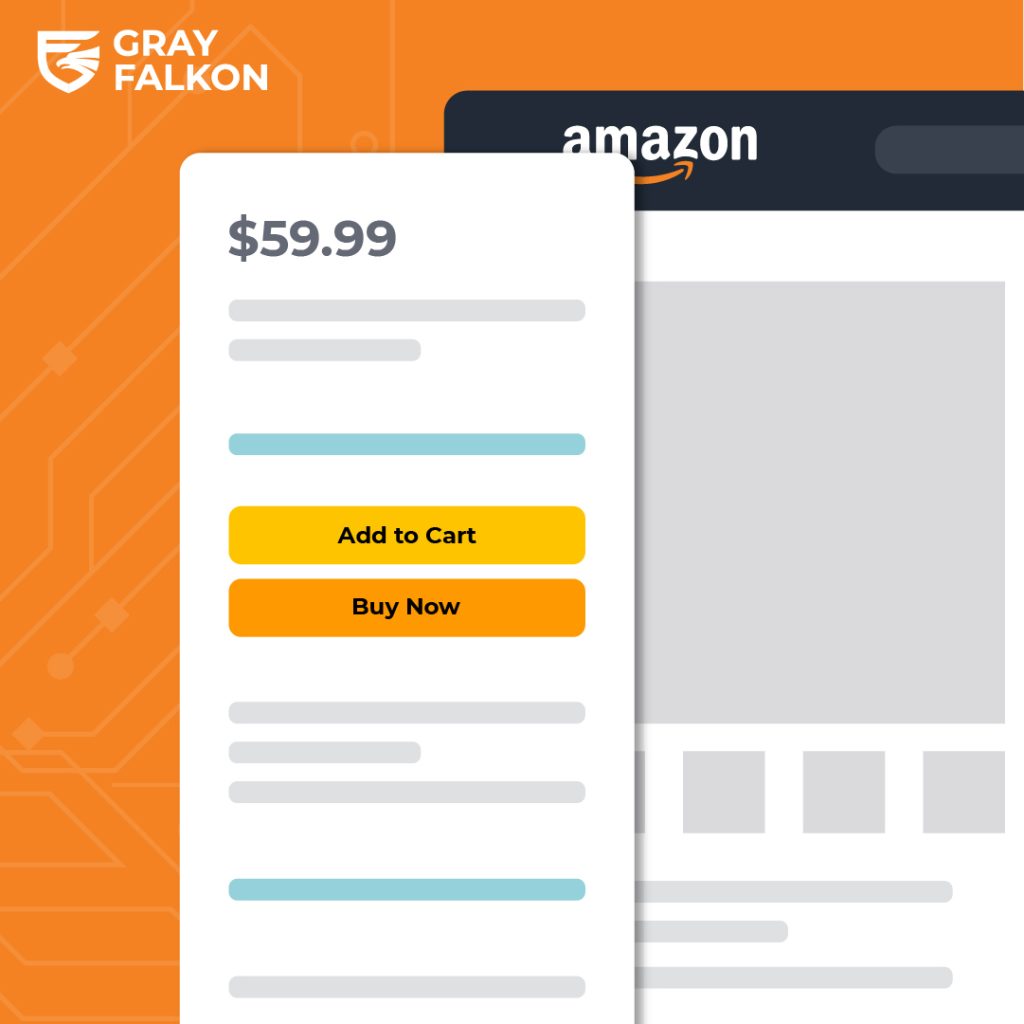

Understanding and Implementing MAP Policies for eCommerce Success

One effective strategy that brands leverage to protect their image and ensure pricing fairness is the implementation of Minimum Advertised Price (MAP) policies.